Why is the Crypto Market Rallying Today? This question is on the minds of many traders, investors, and financial analysts as cryptocurrencies, led by Bitcoin, gain momentum. Key factors include increasing spot Bitcoin ETF inflows, expectations surrounding Federal Reserve rate adjustments, and the positive impacts of short liquidations. This trend highlights growing institutional demand and a strategic response to economic pressures, pushing the market into a phase of significant growth. Phrases like “Spot Bitcoin ETF inflows” and “Federal Reserve rate influence on crypto” shed light on the driving forces.

Key Drivers Behind Today’s Crypto Market Surge

The recent surge in the crypto market, particularly Bitcoin’s robust performance, is driven by a mix of institutional interest, inflows into spot Bitcoin ETFs, central bank policy speculation, and favorable economic signals. These factors are enhancing buying pressure, attracting both institutional and retail investors, and pushing the market towards significant resistance levels.

Spot Bitcoin ETF Inflows and Institutional Demand

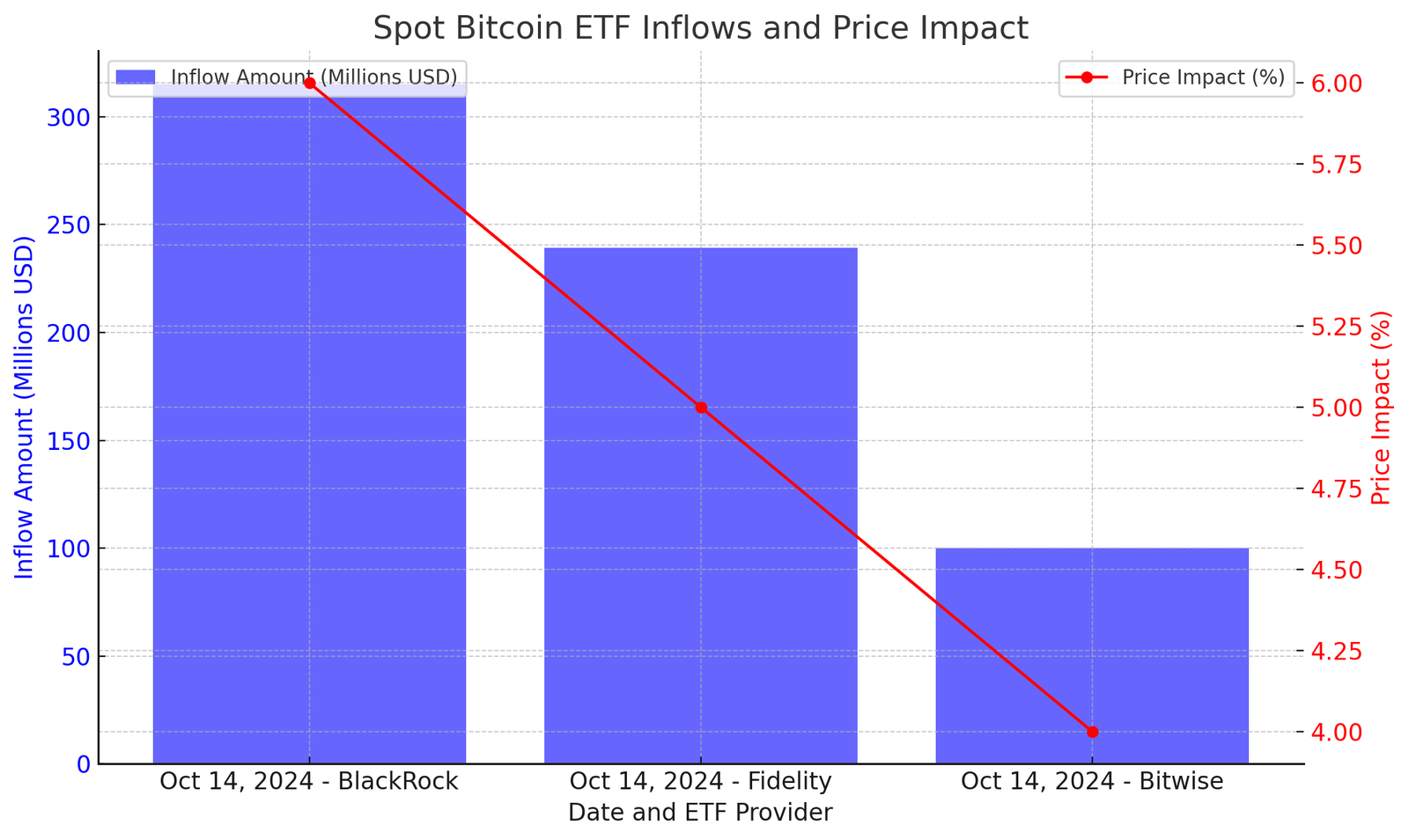

One of the central forces behind the rally is the record-breaking inflows into U.S.-based spot Bitcoin ETFs, which collectively saw nearly $1 billion in new investments over the past week. Major players like BlackRock, Fidelity, and Bitwise led these inflows, with BlackRock’s iShares Bitcoin Trust alone securing $315 million in a single day. This momentum is a strong indicator of institutional investors’ increasing comfort with regulated crypto products. These ETFs provide a regulated, tax-efficient way for institutions to gain exposure to Bitcoin, bridging the gap between traditional finance and digital assets.

| Date | ETF Provider | Inflow Amount | Price Impact Percentage |

|---|---|---|---|

| Oct 14, 2024 | BlackRock | $315 million | Approx. +6% |

| Oct 14, 2024 | Fidelity | $239.3 million | Approx. +5% |

| Oct 14, 2024 | Bitwise | $100 million | Approx. +4% |

the chart displays ETF inflows (in millions of USD) as bars and the corresponding price impact on Bitcoin as a line.

chart uses a line to track both ETF inflows and their respective price impacts over time.

Bitcoin’s Resistance Levels and Short Squeeze Effects

As Bitcoin recently crossed the $70,000 mark, it triggered a wave of short liquidations. Short positions, particularly those betting against Bitcoin, are being rapidly covered, fueling additional buying pressure. This short squeeze creates a positive feedback loop, with each price increase forcing more short positions to close, which then drives prices even higher. Market analysts highlight that Bitcoin’s next major resistance lies between $71,000 and $73,000, and successfully breaking this level could set the stage for a more aggressive rally. This process underscores the heightened bullish sentiment among investors.

Federal Reserve Rate Influence on Crypto Markets

The Federal Reserve’s current stance on interest rates also plays a key role in shaping market expectations. Speculation around potential rate cuts to support the U.S. economy is bolstering Bitcoin’s appeal as an inflation hedge, especially given the persistent inflation rates. Investors are moving towards Bitcoin and other crypto assets as alternative stores of value, expecting that a reduction in rates will weaken the dollar and increase demand for assets like Bitcoin that are viewed as inflation-resistant. This monetary policy outlook is further reinforcing bullish sentiment in the crypto market.

Market Sentiment and Retail Investor Activity

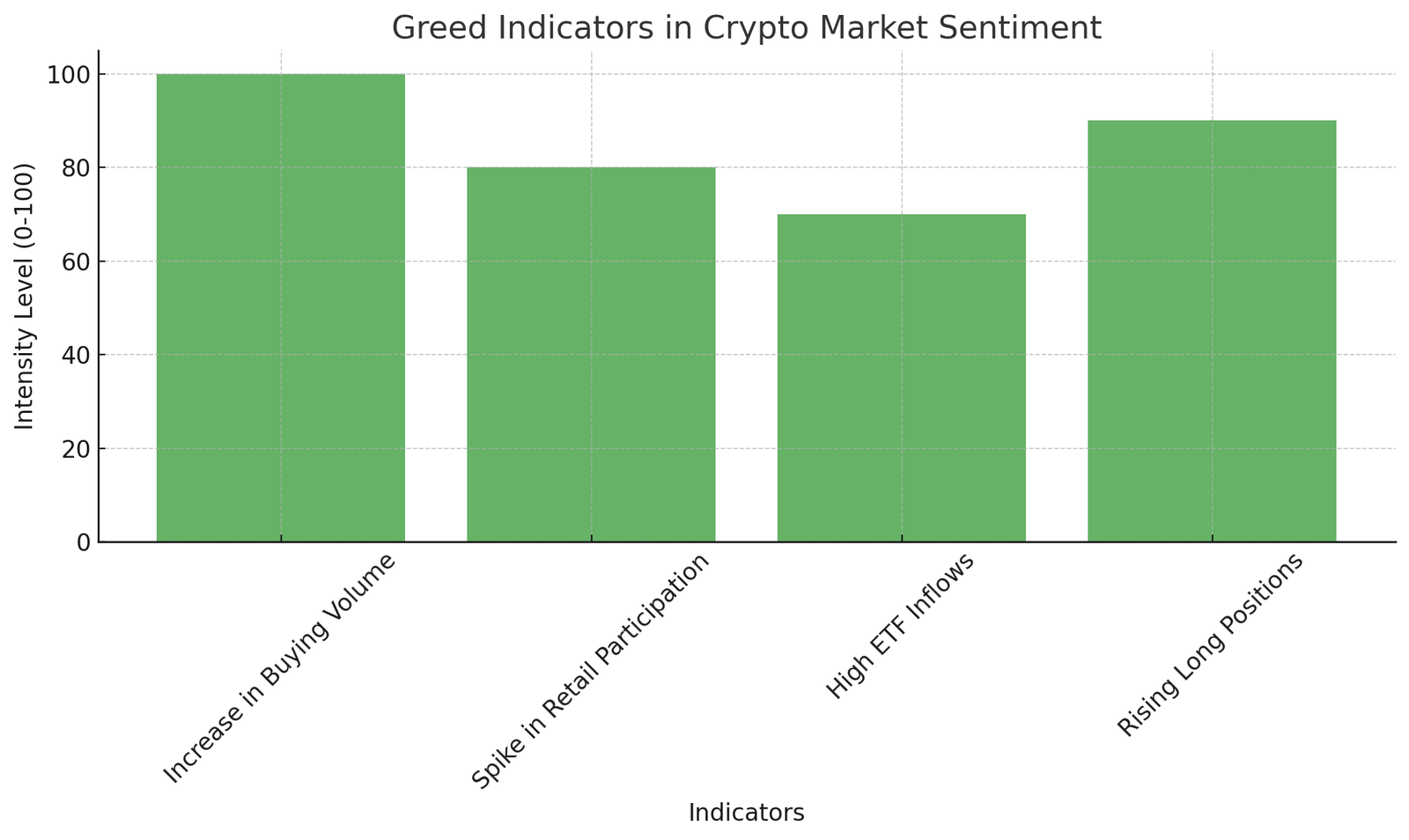

The crypto market is experiencing heightened activity, partly fueled by a positive shift in investor sentiment. Tools like the Fear and Greed Index help gauge this sentiment, providing insights into whether traders are driven by cautious fear or optimistic greed. Presently, the index sits firmly in the “greed” territory, hovering around 71-73, indicating strong confidence among investors that further gains may be imminent. This psychological shift has driven more buying activity as investors aim to capitalize on current market trends.

Fear and Greed Index Indicates Strong Market Confidence

The Fear and Greed Index reveals key indicators of bullish sentiment across the market. At a score of 73, this “greed” level suggests that traders are actively entering the market in anticipation of continued price increases, leading to significant buying volume. This trend is also evident in increased long positions and ETF inflows, which support the upward price momentum. However, this optimism also raises the risk of sudden corrections, as markets driven by high greed levels often become prone to reversals if sentiment shifts quickly.

| Greed Indicators | Implication |

|---|---|

| Increase in Buying Volume | More traders entering the market |

| Spike in Retail Participation | Growing retail interest in crypto |

| High ETF Inflows | Institutional confidence in growth |

| Rising Long Positions | Traders betting on further gains |

the chart presents each indicator’s intensity level, showing the strength of factors like increased buying volume and retail participation.

FOMO and Retail Demand in Bitcoin and Altcoins

Bitcoin’s recent rally, breaking key resistance levels, has spurred a surge in FOMO (Fear of Missing Out) among retail investors. This behavior is not only boosting Bitcoin’s price but also positively impacting altcoins as traders seek diversified crypto opportunities. The elevated retail participation has increased demand across the board, leading to price gains in both major and lesser-known cryptocurrencies. While FOMO is a strong driver of upward momentum, it also heightens the possibility of market corrections if enthusiasm begins to wane.

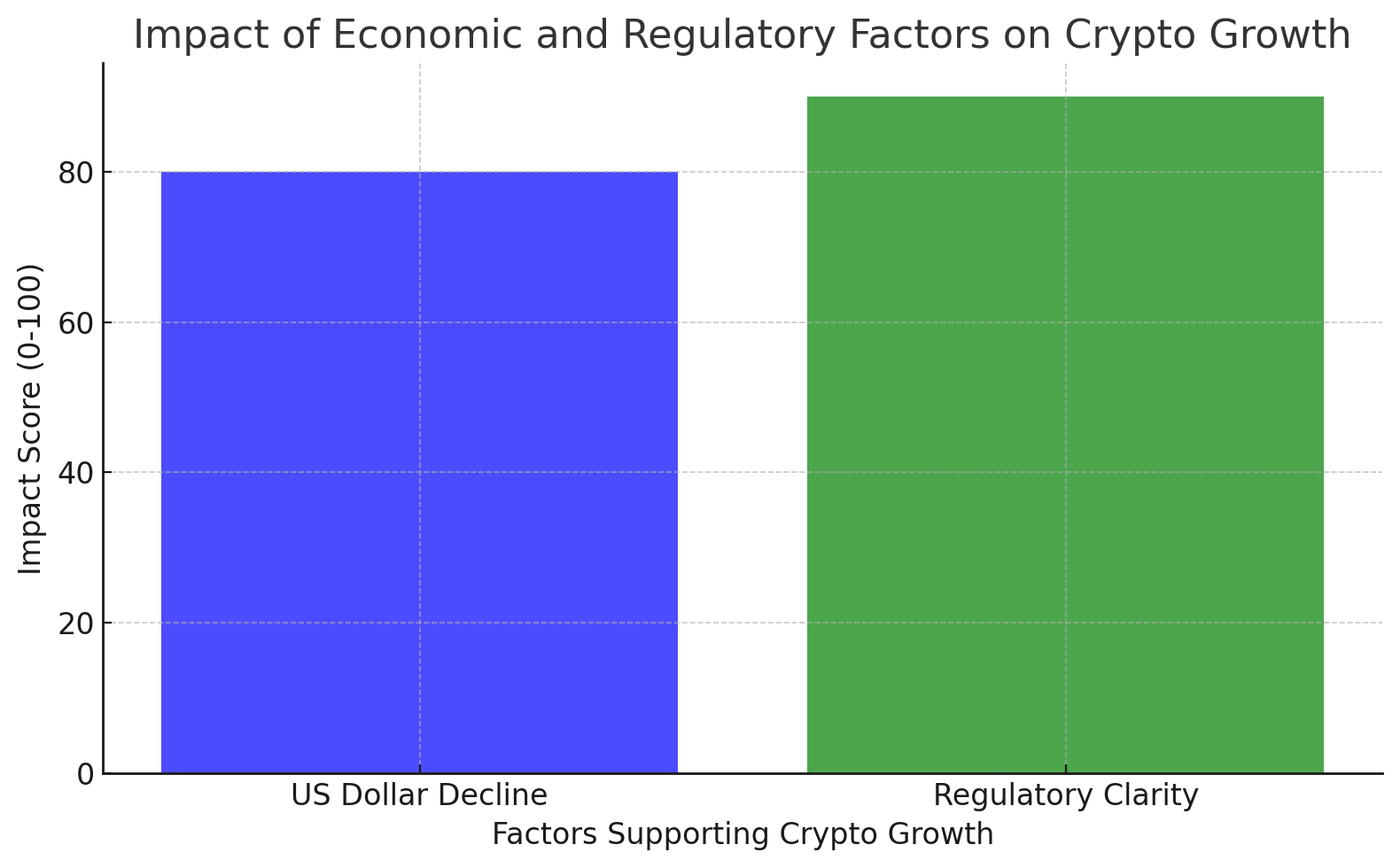

Economic and Regulatory Factors Supporting Crypto Prices

As external economic and regulatory factors continue to influence the crypto market, both the recent weakening of the U.S. dollar and regulatory clarity have created a supportive environment for cryptocurrencies. This section highlights how these developments fuel demand for crypto as a hedge and foster investor confidence in the space.

This chart compares the influence of the U.S. dollar’s decline and regulatory clarity on the crypto market, with an impact score indicating each factor’s relative strength in supporting crypto.

U.S. Dollar Decline and Its Positive Impact on Crypto

The U.S. dollar has seen a downward trend due to factors like potential Federal Reserve rate cuts and growing fiscal pressures. As the dollar loses value, investors are increasingly seeking alternatives to protect against currency devaluation. Cryptocurrencies, especially Bitcoin, have become a preferred option in this context, acting as a hedge similar to gold. For example, Bitcoin prices often rise as the dollar weakens, with some analysts predicting that ongoing dollar volatility could lead to further demand for crypto assets. This dynamic demonstrates how the dollar’s decline supports the growth of risk assets like crypto, appealing to investors looking to diversify and preserve value amidst currency instability.

Regulatory Clarity and Institutional Confidence

Recent regulatory developments have significantly boosted institutional confidence in the crypto sector. Notably, the approval of spot Bitcoin ETFs in the U.S. has provided a regulated, accessible way for institutions to enter the crypto market. Additionally, clearer regulatory stances from the SEC and tax clarifications have helped to alleviate some of the uncertainties that previously hindered institutional participation. This environment has encouraged large-scale investors, such as those utilizing BlackRock and Fidelity ETFs, to increase their crypto holdings. These regulatory advancements suggest a more stable framework for institutional involvement, which, in turn, strengthens market confidence and attracts long-term capital inflows into the crypto space.

Further Reading:

The crypto market’s rally reflects a blend of economic shifts and regulatory advances, positioning digital assets as a robust hedge and attracting institutional interest. Looking forward, sustained market support will depend on the evolving economic landscape and regulatory actions that shape investor trust.